All boletos issued against your CNPJ in one place

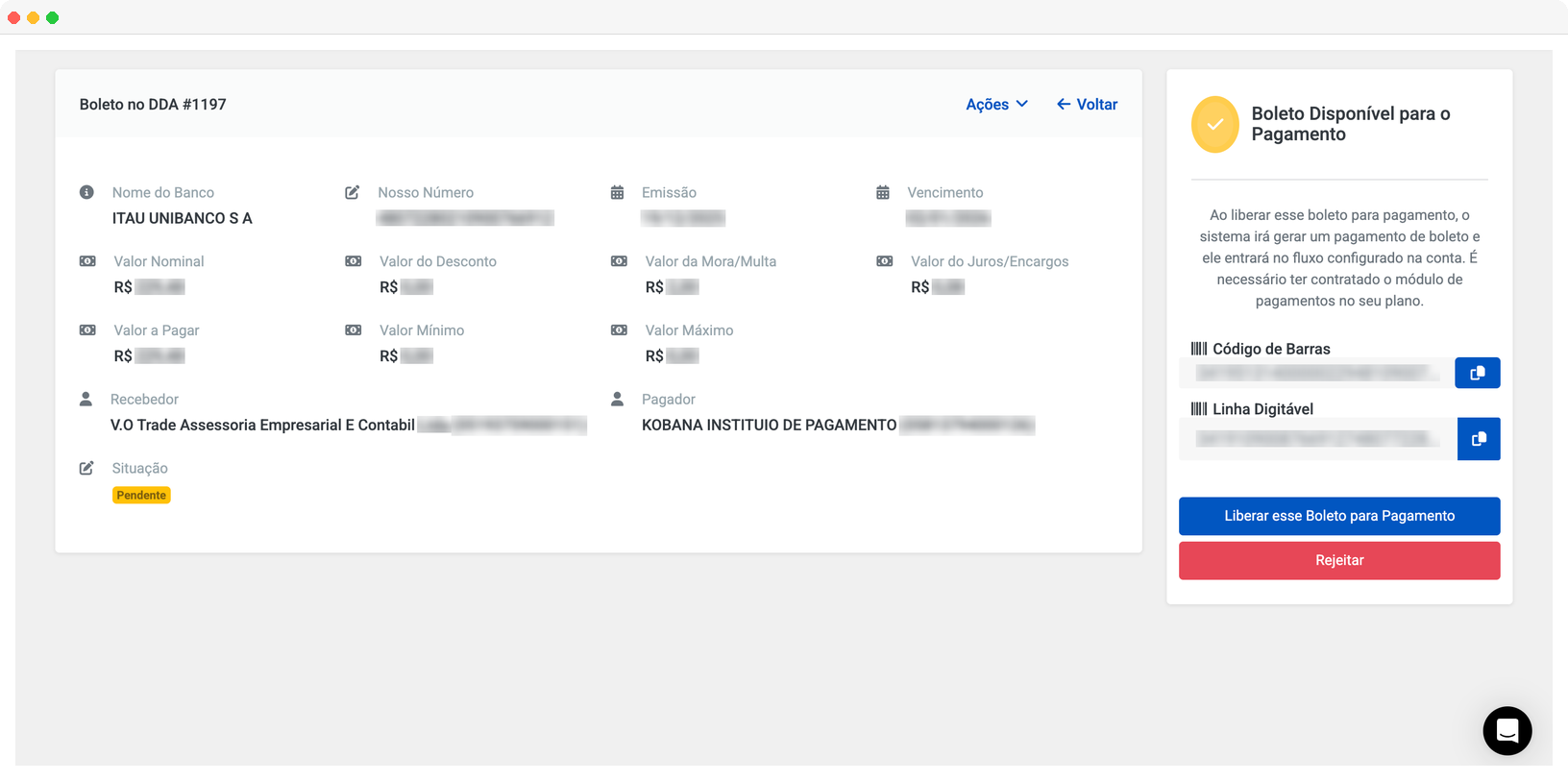

Automatically view boletos your suppliers issued, regardless of the issuing bank. Approve, schedule payments, or reject undue charges. Centralize accounts payable and prevent fraud.

What is DDA?

DDA (Direct Debit Authorization) is an innovation of the Brazilian financial system that revolutionized how companies manage their payment commitments. Created by Febraban and associated banks in 2009, the system allows you to electronically receive all boletos issued against your CNPJ, even before they arrive by email or mail.

Unlike automatic debit, where amounts are debited without your intervention, in DDA each payment requires your individual authorization. This means total control over what leaves your cash, with early visibility of all charges.

How it works at Kobana

We centralize your company's DDA regardless of which bank it chose to receive notifications

Complete control of received boletos

Benefits for Finance

Use cases

Receive boletos from dozens of different suppliers? DDA centralizes everything and facilitates accounts payable management.

- Centralization

- Organization

- Total control

Rent, electricity, internet... recurring boletos appear automatically. Set up quick approval for known expenses.

- Mapped expenses

- Quick approval

- No forgetting

Suspicious of a boleto received by email? Compare with DDA to verify if the data is authentic.

- Data validation

- Security

- Financial protection

Keep records of all received, approved, and rejected boletos. Answer audit requests with ease.

- Complete history

- Traceability

- Compliance

Integrated with major banks

Banco do Brasil

Banco do Brasil Bradesco

Bradesco Itaú

Itaú Santander

Santander Caixa

Caixa Sicoob

Sicoob Sicredi

Sicredi Banrisul

Banrisul Inter

Inter BTG

BTG Safra

Safra BV

BV ABC Brasil

ABC Brasil Ailos

Ailos Arbi

Arbi Banese

Banese Banestes

Banestes BNB

BNB BNP Paribas

BNP Paribas BRB

BRB BS2

BS2 Cora

Cora Credisis

Credisis Cresol

Cresol Daycoval

Daycoval Mercantil

Mercantil Rendimento

Rendimento Sofisa

Sofisa Unicred

Unicred Uniprime

Uniprime Banco Industrial

Banco Industrial Banco do Brasil

Banco do Brasil Bradesco

Bradesco Itaú

Itaú Santander

Santander Caixa

Caixa Sicoob

Sicoob Sicredi

Sicredi Banrisul

Banrisul Inter

Inter BTG

BTG Safra

Safra BV

BV ABC Brasil

ABC Brasil Ailos

Ailos Arbi

Arbi Banese

Banese Banestes

Banestes BNB

BNB BNP Paribas

BNP Paribas BRB

BRB BS2

BS2 Cora

Cora Credisis

Credisis Cresol

Cresol Daycoval

Daycoval Mercantil

Mercantil Rendimento

Rendimento Sofisa

Sofisa Unicred

Unicred Uniprime

Uniprime Banco Industrial

Banco IndustrialFrequently asked questions

Have total control of boletos issued against your company

View, approve, and pay boletos centrally. Prevent fraud and never miss a due date again.