Automatic PIX: frictionless recurring charges

Receive tuition, subscriptions and continuous services automatically. The customer authorizes once and payments happen on the right date, without them having to do anything.

The evolution of direct debit

Automatic PIX is the Central Bank regulated modality that allows recurring charges via PIX. Unlike traditional direct debit, it doesn't depend on bank agreements or bureaucratic processes.

Your customer authorizes once and that's it. Each period, we send the charge to the payer's bank, which processes the payment automatically on the configured date.

- No bank agreements: just need a PIX-enabled account

- One-time authorization: customer approves once, payments follow automatically

- Total control: payer can set limits and cancel at any time

- Free for payers: no fee for those who pay

Automatic PIX

Simplified recurring charges

Choose how your customer will authorize

The Central Bank defined 4 journeys to obtain payer authorization. Kobana supports all of them via API.

Fluxo

- 1Your company requests authorization via API

- 2Customer receives push notification in bank app

- 3Customer approves directly in the app

- 4Recurrence activated automatically

Fluxo

- 1Customer chooses Automatic PIX at checkout

- 2Is redirected to bank app/website

- 3Confirms authorization in bank's secure environment

- 4Returns to your site with active recurrence

Fluxo

- 1You generate a QR Code with charge + authorization

- 2Customer scans and pays the first installment

- 3Upon payment, already authorizes recurrence

- 4Next charges are automatic

Fluxo

- 1You generate a QR Code only with authorization

- 2Customer scans and authorizes recurrence

- 3No debit is made at the moment

- 4Charges begin on configured date

From setup to automatic receipt

Configure once, receive automatically every month

Configure recurrence

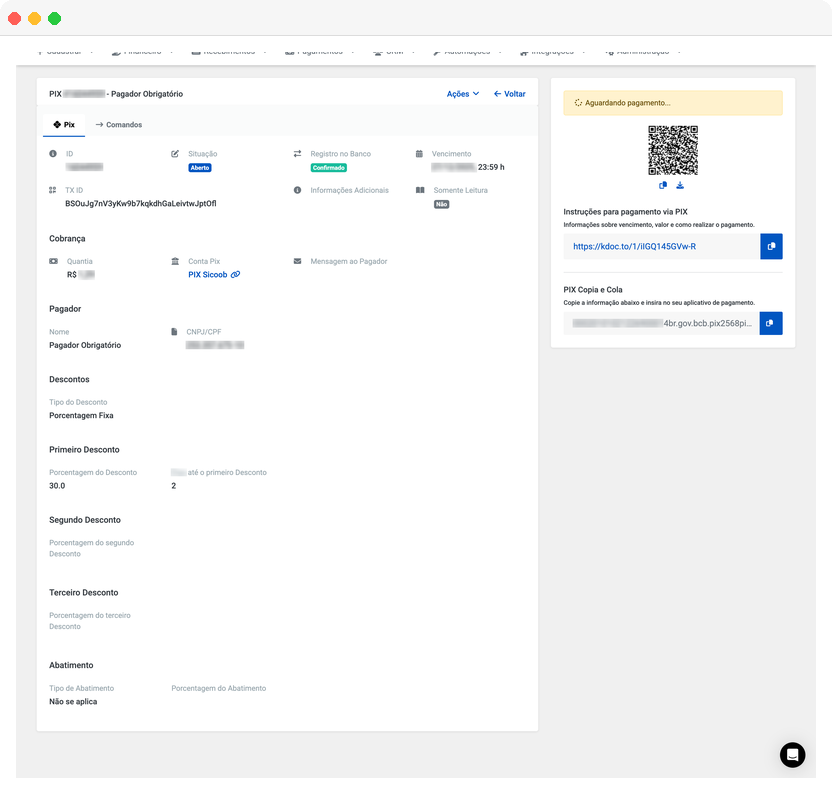

Define amount, frequency (monthly, weekly, etc.), start date and billing rules. All via API or dashboard.

Obtain authorization

Use one of 4 journeys to obtain payer authorization. The customer defines limits and preferences.

We send the charges

Before each due date, we send the payment instruction to the customer's bank. The payer receives a notification.

Receive automatically

On the due date, the payer's bank processes the PIX automatically. You receive the amount and a confirmation webhook.

Why use Automatic PIX in your company

Good for you, good for your customer

Automatic PIX brings benefits for payers too

One-time authorization

Approve once and don't need to do anything every month

Payment on the right date

No delays, no late fees, no worries

Total control

Can set maximum amount and cancel whenever they want

No fees

Automatic PIX is free for payers (BCB regulation)

Management in bank app

Track and manage everything through the app they already use

No card needed

Alternative for those who don't have or don't want to use credit card

Ideal for recurring charges

Charge software subscriptions, streaming, subscription clubs. The customer signs once and payments flow automatically.

- Churn reduction

- Automated billing

- Less delinquency

School tuition, online courses, academies. Reduce delinquency and billing operational work.

- 500 students = zero monthly bank slips

- Punctual receipt

- Less administrative work

Condo fees, rent, installment property taxes. Receive punctually without having to issue bank slips every month.

- On-time condo fees

- Automatic rent

- Less delinquency

Maintenance, technical support, monitoring, insurance. Any service with periodic billing.

- Support contracts

- Monthly maintenance

- 24/7 monitoring

Plan premiums, insurance, pension. High recurrence with low friction for the customer.

- Alternative to direct debit

- Wide customer base

- Guaranteed payment

Gym memberships, sports clubs, associations. Loyalty with frictionless payment.

- 10,000 automated students

- Card migration

- Lower cost

Everything you need via API

- GET /recurrences

- POST /recurrences

- PATCH /recurrences/:uid

- PUT /recurrences/:uid/cancel

- GET /requests

- POST /requests

- GET /requests/:uid

- GET /pix

- POST /pix

- PUT /pix/:uid/retry

- PUT /pix/:uid/cancel

REST API Integration

Our API offers endpoints for all Automatic PIX operations: create recurrences, request authorizations, send charges and track payments.

View complete API documentationcurl -X POST https://api.kobana.com.br/v2/charge/automatic_pix/recurrences \

-H "Authorization: Bearer your_token" \

-H "Content-Type: application/json" \

-d '{

"pix_account_uid": "pix_abc123",

"amount": 99.90,

"description": "Pro Plan Monthly",

"frequency": "monthly",

"start_date": "2025-02-01",

"payer": {

"document_number": "12345678900",

"name": "John Smith",

"email": "john@email.com"

}

}'{

"status": 201,

"data": {

"uid": "rec_0199bc7f908c7d53",

"status": "pending_authorization",

"amount": 99.90,

"frequency": "monthly",

"start_date": "2025-02-01",

"payer": {

"document_number": "12345678900",

"name": "John Smith"

},

"authorization_url": "https://kdoc.to/a/xyz123",

"qrcode_base64": "iVBORw0KGgoAAAANSUhEUgAA..."

}

}Real-time notifications

Receive webhooks for each event in the Automatic PIX lifecycle

| Event | Description |

|---|---|

automatic_pix.authorization.approved | Payer authorized recurrence |

automatic_pix.authorization.rejected | Payer declined authorization |

automatic_pix.authorization.cancelled | Recurrence was cancelled |

automatic_pix.charge.scheduled | Charge scheduled at payer's bank |

automatic_pix.charge.paid | Charge paid successfully |

automatic_pix.charge.failed | Charge failed (insufficient balance, etc.) |

automatic_pix.charge.retried | New charge attempt sent |

Automatic PIX vs. other billing methods

Compare and choose the best option for your operation

| Feature | Automatic PIX | Direct Debit | Recurring Card | Monthly Bank Slip |

|---|---|---|---|---|

| Bank agreement | Not needed | Required | Not needed | Not needed |

| Cost for payer | Free | May have fee | Card fee | Free |

| Authorization | One-time | One-time | One-time | None |

| Customer action | None after authorizing | None after authorizing | None after authorizing | Pay every month |

| Availability | 24/7 | Business days | 24/7 | Business days |

| Reach | 160M+ users | Bank customers | Cardholders | Anyone |

| Setup | Simple via API | Bureaucratic | Simple | Simple |

Central Bank regulated security

Special Return Mechanism (MED)

Protection against fraud and errors

Explicit authorization

Payer needs to actively approve

Configurable limits

Payer defines maximum amount per charge

Cancellation at any time

Payer can revoke via bank app

Prior notification

Payer is notified before each charge

Limited attempts

Up to 3 attempts in case of insufficient balance

Connected to Brazil's major banks

All PIX-enabled banks support Automatic PIX for payers

Banco do Brasil

Banco do Brasil Bradesco

Bradesco Itaú

Itaú Santander

Santander Caixa

Caixa Sicoob

Sicoob Sicredi

Sicredi Banrisul

Banrisul Inter

Inter BTG

BTG Safra

Safra BV

BV ABC Brasil

ABC Brasil Ailos

Ailos Arbi

Arbi Banese

Banese Banestes

Banestes BNB

BNB BNP Paribas

BNP Paribas BRB

BRB BS2

BS2 Cora

Cora Credisis

Credisis Cresol

Cresol Daycoval

Daycoval Mercantil

Mercantil Rendimento

Rendimento Sofisa

Sofisa Unicred

Unicred Uniprime

Uniprime Banco Industrial

Banco Industrial Banco do Brasil

Banco do Brasil Bradesco

Bradesco Itaú

Itaú Santander

Santander Caixa

Caixa Sicoob

Sicoob Sicredi

Sicredi Banrisul

Banrisul Inter

Inter BTG

BTG Safra

Safra BV

BV ABC Brasil

ABC Brasil Ailos

Ailos Arbi

Arbi Banese

Banese Banestes

Banestes BNB

BNB BNP Paribas

BNP Paribas BRB

BRB BS2

BS2 Cora

Cora Credisis

Credisis Cresol

Cresol Daycoval

Daycoval Mercantil

Mercantil Rendimento

Rendimento Sofisa

Sofisa Unicred

Unicred Uniprime

Uniprime Banco Industrial

Banco IndustrialFrequently asked questions

Ready to automate your recurring charges?

Create your account and start using Automatic PIX. Our API is ready and documented.