Receive via PIX with instant confirmation

Generate static, dynamic QR Codes or charges with due dates. Get real-time notifications when payment is confirmed. Direct integration with major banks.

Choose the ideal PIX type for each situation

We offer different PIX modalities to meet all billing needs. From single payments to recurring charges with due dates.

Ideal para

- Counter and point of sale

- Donations and contributions

- In-person payments

Características

- Permanent and reusable QR Code

- Amount can be fixed or open

- Linked to your PIX key

- Manual reconciliation required

Ideal para

- E-commerce sales

- Online checkout

- One-time transactions

Características

- Unique QR Code per charge

- Mandatory pre-defined amount

- Configurable expiration

- Automatic reconciliation via txid

Ideal para

- Tuition and subscriptions

- Accounts receivable

- Bank slip replacement

Características

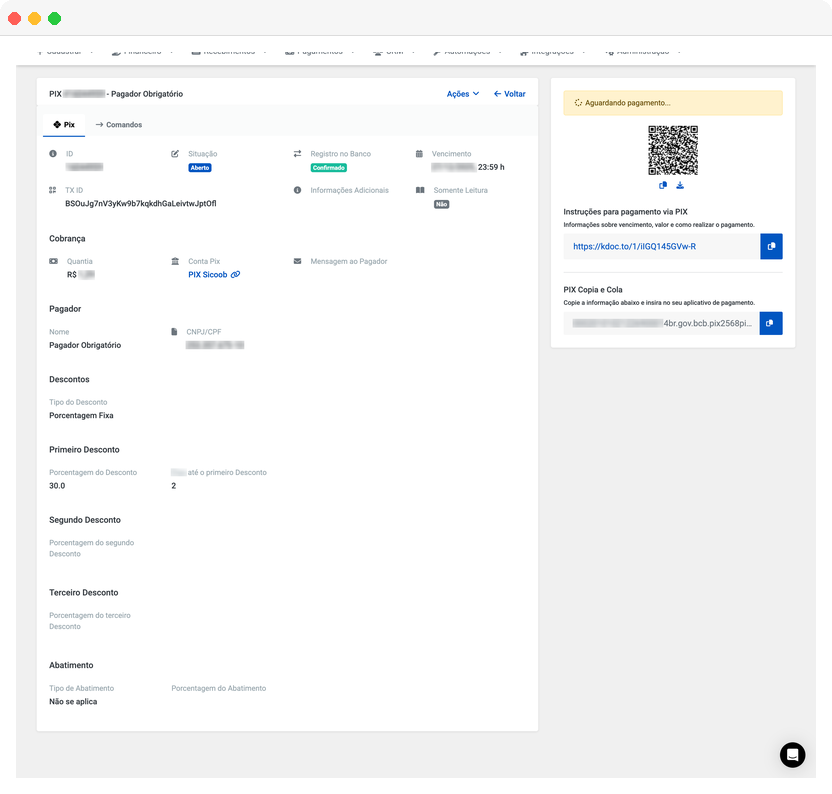

- Configurable future due date

- Interest and late fees after due date

- Up to 3 discount tiers

- Revocation period

Ideal para

- Sending via email or WhatsApp

- Desktop payments

- Accessibility

Características

- BCB standard EMV code

- Easy sharing

- Works in any app

- Ideal without camera

Ideal para

- Monthly subscriptions

- Recurring plans

- Continuous services

Características

- One-time customer authorization

- Automatic recurring debit

- Cancellation at any time

- Regulated by BCB

Your PIX charges always available

We host your PIX charges with the highest security standards. Share in various ways through the shortened address.

Every PIX charge receives a short link in the format kdoc.to/1/xyz123. Easy to copy, share and remember.

- Works forever

- Smaller than attachments

- No spam folder

- SMS

- Telegram

- Any channel

The customer accesses the link and views the charge directly in the browser. Can scan the QR Code or copy the code.

- High resolution QR Code

- Copy-and-paste code

- Payment information

- Clear instructions

Download the QR Code in PNG for use in printed materials, websites or applications.

- High resolution PNG

- Ready for printing

- Marketing materials

- System integration

Charges hosted with encryption and protection. Payer data protected.

- HTTPS on all pages

- Encrypted data

- Integrity validation

- Access logs

Configure late fees, interest and discounts

Set payment conditions for PIX charges with due dates. Everything calculated automatically by the system, just like bank slips.

Late Fee

Fixed fee charged when the customer pays after the due date. Configure according to your billing policy.

Opções

- No fee (exempt)

- Percentage on amount (e.g., 2%)

- Fixed amount (e.g., $10.00)

Late Interest

Progressive charge that increases with days of delay. Encourages on-time payment.

Opções

- No interest (exempt)

- Daily interest (e.g., 0.033%/day)

- Monthly interest (e.g., 1%/month)

Early Payment Discount

Reduce the charge amount if paid before a certain date. Encourage early payments.

Opções

- Percentage discount (e.g., 5%)

- Fixed amount discount

- Up to 3 discount tiers

Exemplo

10 days early: 10% | 5 days early: 5% | By due date: 2%

Billing features

What you can do

- Documented REST API

- SDK for Ruby, Python, Node.js

- Batch generation

- Webhook in seconds

- Multiple callback URLs

- Automatic retry

- High resolution PNG

- Copy-and-paste EMV code

- Shortened kdoc.to link

- Unique txid per charge

- Automatic matching

- Complete history

- Custom fields

- Unlimited metadata

- Tags for organization

- Cancellation via API

- Amount modification

- Validity extension

How it works

Configure your PIX account

Connect your bank account via digital certificate. We support major banks with PIX API.

Create the charge

Use our API or dashboard to create charges. Define amount, type and payer data.

Share the QR Code

Send the QR Code or link via email, WhatsApp, SMS or display on your website/app.

Receive confirmation

As soon as the customer pays, you receive an instant webhook. The status updates in real time.

Simple API, instant payment

Create PIX charges with a single request. Receive the QR Code ready to use.

View complete API documentationcurl -X POST https://api.kobana.com.br/v2/charge/pix \

-H "Authorization: Bearer your_token" \

-H "Content-Type: application/json" \

-d '{

"amount": 150.00,

"pix_account_uid": "pix_abc123",

"registration_kind": "instant",

"expire_at": "2025-01-15T23:59:59Z",

"payer": {

"document_number": "12345678900",

"name": "John Smith",

"email": "john@email.com"

},

"message": "Payment for order #1234"

}'{

"status": 201,

"data": {

"uid": "0199bc7f-908c-7d53-b533-ad041fd8396a",

"status": "opened",

"registration_status": "pending",

"kind": "instant",

"amount": 150.00,

"expire_at": "2025-01-15T23:59:59Z",

"payer": {

"document_number": "12345678900",

"name": "John Smith"

},

"url": "https://kdoc.to/1/aTdky2CzswAG",

"formats": {

"default": { "html": "...", "png": "...", "pdf": "..." },

"qrcode": { "html": "...", "png": "...", "pdf": "..." }

}

}

}Connect your PIX account from major banks

Direct integration via bank API. No intermediaries, no hidden fees.

Banco do Brasil

Banco do Brasil Bradesco

Bradesco Itaú

Itaú Santander

Santander Caixa

Caixa Sicoob

Sicoob Sicredi

Sicredi Banrisul

Banrisul Inter

Inter BTG

BTG Safra

Safra BV

BV ABC Brasil

ABC Brasil Ailos

Ailos Arbi

Arbi Banese

Banese Banestes

Banestes BNB

BNB BNP Paribas

BNP Paribas BRB

BRB BS2

BS2 Cora

Cora Credisis

Credisis Cresol

Cresol Daycoval

Daycoval Mercantil

Mercantil Rendimento

Rendimento Sofisa

Sofisa Unicred

Unicred Uniprime

Uniprime Banco Industrial

Banco Industrial Banco do Brasil

Banco do Brasil Bradesco

Bradesco Itaú

Itaú Santander

Santander Caixa

Caixa Sicoob

Sicoob Sicredi

Sicredi Banrisul

Banrisul Inter

Inter BTG

BTG Safra

Safra BV

BV ABC Brasil

ABC Brasil Ailos

Ailos Arbi

Arbi Banese

Banese Banestes

Banestes BNB

BNB BNP Paribas

BNP Paribas BRB

BRB BS2

BS2 Cora

Cora Credisis

Credisis Cresol

Cresol Daycoval

Daycoval Mercantil

Mercantil Rendimento

Rendimento Sofisa

Sofisa Unicred

Unicred Uniprime

Uniprime Banco Industrial

Banco IndustrialUse cases

Offer PIX at checkout and confirm payment instantly. Release the order without waiting for clearing.

- Higher conversion than bank slips

- Faster delivery

- Less cart abandonment

Charge monthly fees with PIX Charge. Configure interest for late payments and discounts for early payment.

- Less delinquency

- Predictable cash flow

- Complete automation

Send charges via WhatsApp with QR Code or link. Get paid instantly and hassle-free.

- Immediate receipt

- Satisfied customer

- Zero complications

Receive the total payment and automatically split it between sellers. All reconciled.

- Simplified operation

- Automatic payouts

- Full control

Everything you need to receive via PIX

Automatic duplicate

Customer can access the QR Code via link at any time

Amount modification

Change amounts before payment

Cancellation

Cancel unpaid charges directly in the dashboard or via API

Charge copy

Duplicate existing charges to quickly create new ones

Status control

Track in real time: open, paid, expired, cancelled

Notes

Add internal notes to organize your operation

Refund

Process full or partial refunds

Tags and metadata

Organize charges with tags and custom data

Advanced filters

Search by status, customer, amount, period

Reports

Export data for analysis and reconciliation

Frequently asked questions

Ready to receive instant payments?

Create your account, connect your bank and start receiving via PIX today. Setup in minutes.