Explore Kobana from the inside

Explore the main features of the platform and discover how Kobana can transform your company's financial management.

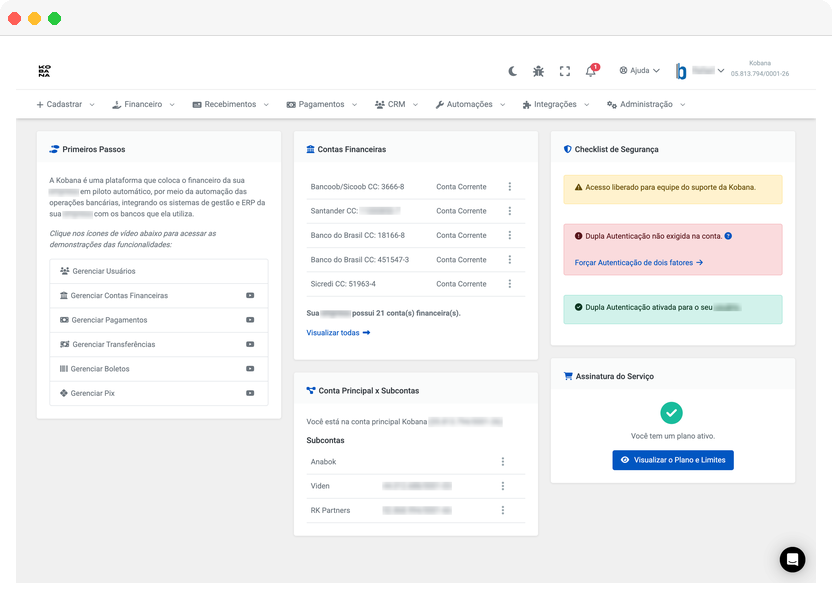

Main Dashboard

Your financial command center

Kobana's dashboard offers a consolidated view of all your financial operations. In one place, you can track balances, recent transactions, and key indicators.

View the available balance across all your connected bank accounts. Automatic or on-demand updates.

Track the latest movements: paid boletos, received PIX, completed transfers.

Stay informed about important events: upcoming boleto due dates, confirmed payments, processing errors.

Shortcuts to the most frequent operations: issue boleto, make transfer, check statement.

Account Management

All your accounts in one place

Register and manage multiple bank accounts, billing wallets, and PIX accounts centrally.

Add accounts from different banks with just a few clicks. Configure data such as branch, account, and operation type.

Configure specific wallets for boleto issuance. Set parameters like instructions, fines, and interest.

Register PIX keys for receiving payments. Support for random keys, CPF/CNPJ, email, and phone.

Define who has access to each account and what operations they can perform.

Billing and Boletos

Issue boletos with automatic registration

Kobana automates the entire boleto issuance process: from bank registration to payment tracking.

Generate one boleto at a time or import a spreadsheet with hundreds of titles. Bank registration is automatic.

Add PIX QR Code to the boleto so the payer can choose the payment method. Automatic reconciliation in both cases.

Configure automatic email and SMS sends: reminders before due date, boleto availability notice, post-due collection.

View the status of each boleto: registered, paid, overdue, cancelled. Receive payment notifications via webhook.

PIX

Receive and send with instant PIX

Use PIX for fast receivables or to make payments and transfers in seconds.

Generate a fixed QR Code to receive variable amounts. Ideal for point of sale and donations.

Create charges with defined amount and due date. Full control over each transaction with automatic reconciliation via txid.

Every boleto can include a PIX QR Code. If the payer uses PIX, Kobana identifies and clears the boleto automatically.

Send payments by entering the recipient's PIX key or pasting the code from a PIX QR Code.

Payments

Pay bills directly through the platform

Centralize supplier payments, taxes, and utility bills. Schedule, approve, and track everything in one place.

Pay supplier boletos and bills like water, electricity, and phone by entering the barcode.

Pay federal taxes, government fees, and state/municipal taxes directly.

Schedule payments for future dates. Kobana processes them automatically on the day.

For greater control, configure approval workflows. Process multiple payments at once.

Transfers

Transfer funds securely

Make transfers to any bank using PIX or TED. Define beneficiaries, schedule sends, and track each operation.

Instant transfer, 24 hours a day, 7 days a week. Immediate arrival in the recipient's account.

Traditional transfer between banks. Processing on business days, usually same day.

Group multiple transfers for joint processing and approval.

Register frequent recipients to speed up future operations.

Statements and Reconciliation

Check movements and reconcile automatically

Access statements from all your accounts and let Kobana automatically identify which payments correspond to which charges.

View movements from multiple accounts on a single screen. Filter by period, operation type, or amount.

For banks with API integration, statements are updated automatically. For others, import OFX or CNAB files.

Kobana cross-references received payment information with issued boletos, automatically identifying settlements and partial payments.

Export statements in CSV, PDF, or OFX to import into your management or accounting system.

Bank Connections

Connect your banks securely

Kobana offers different integration methods to meet the particularities of each bank and need.

Real-time connection with the bank through official APIs. Offers greater speed and complete functionality.

Traditional integration via remittance and return files. Compatible with any bank.

Combine API for some operations and files for others, leveraging the best of each method.

Configure API credentials, digital certificates, and access keys securely.

Continue exploring

Now that you know the platform, how about scheduling a personalized demo or exploring our technical documentation?

Schedule a conversation with our team and get all your questions answered.

Schedule a callDevelopers can explore our API and integration examples.

View documentationReady to simplify your financial management?

Schedule a call and discover how Kobana can help your company.