Boleto + PIX: the best of both worlds

Offer two payment methods in a single document. Your customer chooses to pay by bank slip or PIX, and you receive with the same ease.

Why use Bolepix

- Average increase: +15% to +25% in conversion

- Confirmation time: Seconds, not days

- Result: Less confusion, more convenience

- Result: Zero manual reconciliation work

Choose how to manage your hybrid bank slip

We offer two ways to implement Bolepix. Choose the one that makes most sense for your business and your banks.

Managed by Kobana

We combine bank slips and PIX synchronously, even from different banks. Two separate operations that work as one.

Vantagens

- Total flexibility in bank choice

- Bank slip from one bank with PIX from another

- Works with banks that don't offer native hybrid

- Operations synchronized automatically

- When one is paid, the other is written off

Considerações

- Two distinct operations (bank slip + PIX)

- Requires separate PIX account configuration

Requisitos

- Configured and approved receivables portfolio

- PIX account activated at Kobana

- Connection allowing communication between bank slip and PIX

Managed by Bank

The bank itself generates the hybrid bank slip as a single operation. Ideal for those who already have the service contracted with the institution.

Vantagens

- Single operation at the bank

- Centralized management at the institution

- May have lower cost depending on the bank

Considerações

- Portfolio and PIX must be from the same bank

- Requires prior contract with the institution

- Dependent on bank support

- Works only via API, not by remittance

Requisitos

- Configured and approved receivables portfolio

- Billing connection with the bank via API

- Itau Bank: also requires configured PIX connection

Simple for you, simple for your customer

Configure portfolio for Bolepix

Access your bank slip portfolio and enable hybrid bank slip. Choose between managed by Kobana or by the bank.

Issue the bank slip normally

Create the bank slip as you always have. The PIX QR Code is generated automatically along with the barcode.

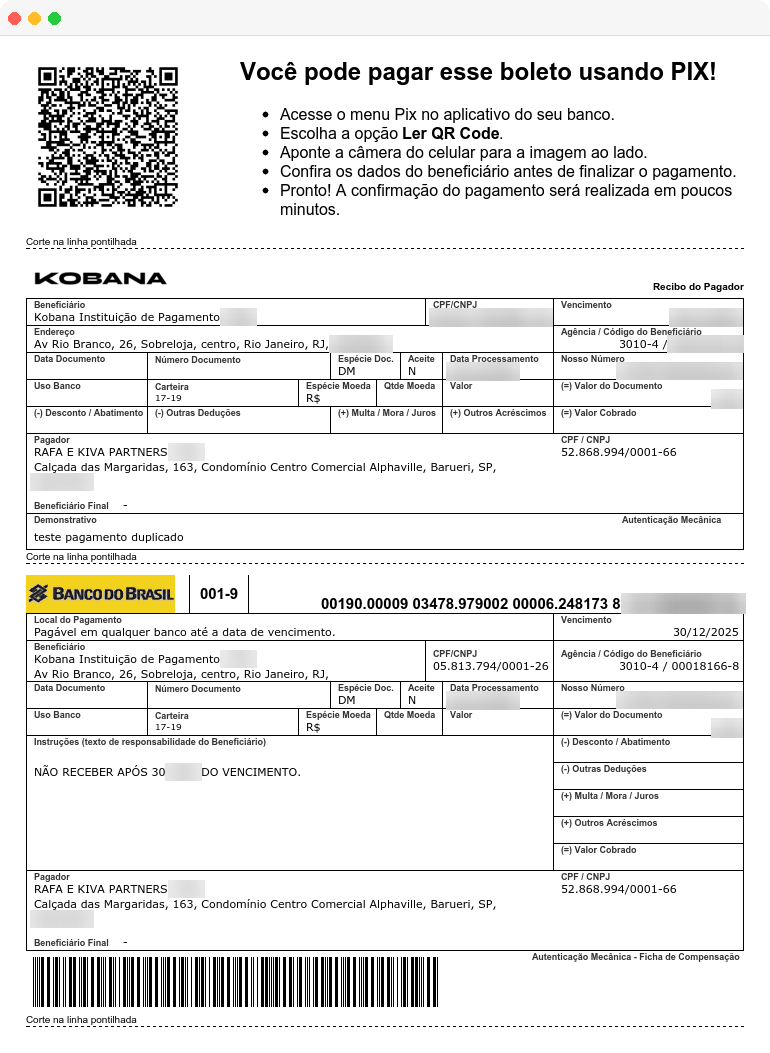

Customer receives single document

Your customer receives a standard FEBRABAN bank slip with barcode AND an integrated PIX QR Code.

Payment by bank slip OR PIX

The customer chooses: pay via barcode (traditional) or scan the QR Code and pay instantly via PIX.

Bank Slip Features in Bolepix

Everything you already know from traditional bank slips, now with integrated PIX.

PIX Features in Bolepix

Take advantage of the best of PIX right in your bank slip.

Use cases

Send tuition with Bolepix. Parents can pay instantly via mobile or keep the bank slip for the due date.

- More on-time payments

Condo fee with PIX option. Residents pay via app without typing the barcode.

- Fewer expired bank slips

Offer Bolepix at checkout. Customer who was going to pay by bank slip can opt for PIX and you release the order faster.

- Faster delivery

Send the consultation bank slip. Patient can pay before or after the appointment, however they prefer.

- Payment flexibility

Monthly fee with Bolepix. Student pays via bank app and unlocks the turnstile the same day.

- Modern experience

Recurring billing with two options. Customer chooses how to pay each invoice.

- Lower payment churn

Integrated with major banks

Banco do Brasil

Banco do Brasil Bradesco

Bradesco Itaú

Itaú Santander

Santander Caixa

Caixa Sicoob

Sicoob Sicredi

Sicredi Banrisul

Banrisul Inter

Inter BTG

BTG Safra

Safra BV

BV ABC Brasil

ABC Brasil Ailos

Ailos Arbi

Arbi Banese

Banese Banestes

Banestes BNB

BNB BNP Paribas

BNP Paribas BRB

BRB BS2

BS2 Cora

Cora Credisis

Credisis Cresol

Cresol Daycoval

Daycoval Mercantil

Mercantil Rendimento

Rendimento Sofisa

Sofisa Unicred

Unicred Uniprime

Uniprime Banco Industrial

Banco Industrial Banco do Brasil

Banco do Brasil Bradesco

Bradesco Itaú

Itaú Santander

Santander Caixa

Caixa Sicoob

Sicoob Sicredi

Sicredi Banrisul

Banrisul Inter

Inter BTG

BTG Safra

Safra BV

BV ABC Brasil

ABC Brasil Ailos

Ailos Arbi

Arbi Banese

Banese Banestes

Banestes BNB

BNB BNP Paribas

BNP Paribas BRB

BRB BS2

BS2 Cora

Cora Credisis

Credisis Cresol

Cresol Daycoval

Daycoval Mercantil

Mercantil Rendimento

Rendimento Sofisa

Sofisa Unicred

Unicred Uniprime

Uniprime Banco Industrial

Banco IndustrialFrequently asked questions

Two ways to receive, zero complications

Enable Bolepix and offer more options to your customers. Setup takes just a few minutes.